The forex rising wedge (also known as the ascending wedge) pattern is a powerful consolidation price pattern formed when price is bound between two rising trend lines. It is considered a bearish chart formation which can indicate both reversal and continuation patterns – depending on location and trend bias. Regardless of where the rising wedge appears, traders should always maintain the guideline that this pattern is inherently bearish in nature (see image below). Consider a theoretical example of trading a wedge chart pattern involving the EUR/USD currency pair. The rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. It is the opposite of the bullish falling wedge pattern that occurs at the end of a downtrend.

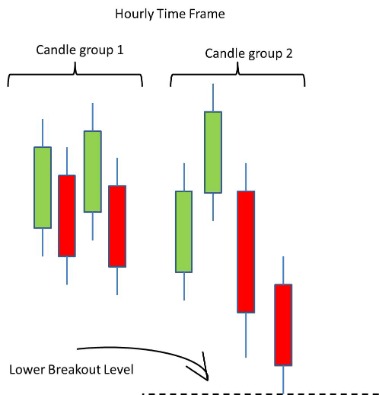

The way that we would do that is by confirming that the rising wedge occurs after a prolonged price move. As we can see from the price chart, the price action leading up to the rising wedge was clearly bullish. Notice how the upper trendline connects higher highs, and how the lower trendline connects lower lows. As such, this wedge is expanding or broadening as the price action progresses. The implications of the broadening wedge are similar to that of the rising wedge. Rising market and confirm the top with a Japanese candlestick reversal formation

(we’ll look at some of the different Candlestick formations to look out for soon).

This was done intentionally because the reversal variation offers the best tradable opportunities as it relates to this formation. The downward sloping trendlines represent the falling wedge formation. You can see how the price action was contracting during the late stages of this bearish trend. Let’s now shift our attention to a trade that demonstrates the falling wedge pattern. On the chart below, you will find another example of a wedge pattern in forex.

How to identify a wedge pattern in forex charts?

We use the same rules as the previous example but apply them to when the price breaks out of the wedge formation to the upside. Another strategy is to enter a position upon a trend reversal, as indicated by a move above or below the trendlines. When trading the falling wedge, I like to enter when price moves above the second to last swing high. In this article, we will explore both the ascending wedge and descending wedge price patterns, their main characteristics, and how to trade them. You can measure the height of the wedge by connecting the two trend lines, ideally from the point at which the wedge started.

It is characterized by two converging upper and lower trendlines where each trend line displays a downward slope. Despite its declining nature, the falling wedge generally breaks to the upside as shown in the image below. In trading, a bearish pattern is a technical chart pattern that indicates a potential trend reversal from an uptrend to a downtrend.

Wedge Patterns

Traders using wedge patterns need to accurately draw each upper and lower trendline of these patterns through the notable swing highs and lows that the market made during the pattern’s lifetime. Once a breakout occurs, the typically measured move of a wedge pattern is determined by projecting the initial width of the wedge from its breakout point. When a rising wedge pattern appears on a currency pair’s exchange rate chart, it has two upward-sloping trend lines. The upper of the two converging trendlines represents resistance, while the lower trendline represents support.

The falling wedge pattern will also be outlined using two contracting trendlines. But in this case the two converging trendlines that contain the price action will be pointing downward. The upper trendline represents diagonal resistance, while the lower trendline represents diagonal support.

- The next chart example shows an ascending wedge pattern that formed during a downtrend.

- The performance quoted may be before charges, which will reduce illustrated performance.Please ensure that you fully understand the risks involved.

- Traders can use support and resistance levels to determine the validity of the pattern and enter profitable trades.

- For a rising wedge, you would draw a trendline connecting the higher highs and a second trendline connecting the higher lows.

TradingWolf and the persons involved do not take any responsibility for your actions or investments. Essentially, we want to clearly define an overbought market during an uptrend, and an oversold market during a downtrend. We will utilize the standard Bollinger band settings of 20, 2 as the parameters.

Step 4: Enter a Trade

The correction takes place, which happens in the formation of a falling wedge. Two trend lines converge and before they eventually intersect, the price breaks out higher. In a rising wedge, the higher lows are rising at a faster pace than the higher highs, which translates into two trend lines converging to a point where they intersect. Under this scenario, the rising wedge is considered to be a bearish pattern, as it represents an upward correction in a downtrend. In this strategy, trading volume and technical momentum indicators such as RSI and MACD are used to validate the wedge pattern’s trading signals. When these indicators align with the pattern’s direction, traders can gain more confidence in their trading decisions.

- Once the short entry order was filled, we would immediately place a stop loss to protect our position.

- And similarly the price action following the break of the upper line within a falling wedge will often lead to a sharp reversal to the upside.

- Notice how the falling trend line connecting the highs is steeper than the trend line connecting the lows.

- In this article, we will take an in-depth look at wedge patterns and explore the benefits of incorporating them into your trading strategy.

Of course, nothing is certain and if the buyers are more willing and strong, this pattern may be broken in the direction of the… The formation of a falling wedge during an upswing usually indicates that the trend will continue. The short entry signal would occur at the break of the low of the candle that penetrated the upper limit of the Bollinger band.

Mastering Forex Divergence Strategies for Profitable Trading

These trades would seek to profit on the potential that prices will fall. The trader now watches the market carefully as the apex of the wedge approaches. Once the trader observes a bearish breakout below the rising wedge’s lower trendline, they look to confirm that the breakout occurred on a rise in trading volume. They initially look to sell just below the wedge’s broken lower trendline, while placing their stop-loss order safely above the upper trendline of the rising wedge.

When I am trading the rising wedge, I generally take the initial breakout that moves below the second to last test of the bottom trendline. The example above shows that there is no immediate retest of the breakout lower. Retests do happen, but they are less frequent than what we see in the ascending, descending and symmetrical triangles. Rising wedges appear regularly in the financial markets and traders gravitate towards the pattern because of its simplicity in identification and application. This article will explain how to spot a rising wedge on forex charts and how to trade them.

How to Trade the Wedge Pattern in Forex

A falling or descending wedge has the opposite structure of the rising wedge. Within the pullback, two trend lines connect the lower highs and lower lows as the volume decreases. The reversal is either bearish or bullish, depending on how the trend lines converge, what the trading volume is, and whether wedge pattern forex the wedge is falling or rising. Note that a wedge pattern’s breakout point is where the exchange rate’s movement is likely to be the strongest and sharpest. Watching the market closely for this event can offer traders a favorable risk-to-reward ratio if they can get into the market promptly.

XAU/USD Price Forecast: Is the Tide Turning for Gold? – DailyFX

XAU/USD Price Forecast: Is the Tide Turning for Gold?.

Posted: Sun, 20 Aug 2023 07:00:00 GMT [source]

The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners. Any information or advice contained on this website is general in nature only and does not constitute personal or investment https://g-markets.net/ advice. We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

We would immediately place a stop loss just below the swing low preceding the entry signal. That would coincide with the low of the pin bar as noted on the price chart. Broadening wedges are trickier to trade compared to the traditional contracting wedge formation. One of the reasons for this is that the broadening variety creates a less attractive risk to reward profile compared to the contracting wedge formation. There are two primary wedge patterns,

the Falling

Wedge (descending) pattern and

the Rising

Wedge (ascending)

pattern. You will be able to spot these patterns in candlestick charts easily, but we like to set up our resistance and rising support levels through our line graphs to give us a better representation.

If the top line of the rising wedge pattern breaks, then it signals a bullish follow-on move, while if the bottom line breaks, it signals a bearish follow-on move. When a security’s price has been falling over time, a wedge pattern can occur just as the trend makes its final downward move. The trend lines drawn above the highs and below the lows on the price chart pattern can converge as the price slide loses momentum and buyers step in to slow the rate of decline. Before the lines converge, the price may breakout above the upper trend line. A wedge is a price pattern marked by converging trend lines on a price chart.

Beginner’s Guide to Reading and Understanding Forex Broker Reviews

This duality presents both bullish and bearish scenarios, adding complexity to traders’ decision-making when using this pattern, so waiting for a breakout is essential before trading based on this pattern. Broadening wedges are also known as megaphone patterns since they look like a megaphone tilted upwards or downwards. Like with the narrowing wedge patterns previously discussed, both trendlines of a broadening wedge slope in the same direction, although they diverge in the megaphone pattern. Just like in the other forex trading chart patterns we discussed earlier, the price movement after the breakout is approximately the same magnitude as the height of the formation.